Most Americans seem to have little knowledge of personal finance. This article shows the basics of how you can earn profits that last your lifetime. You will learn how to stretch your money further and learn how to make more on the side.

When trading in the Forex market it is important to watch the trends. You want to buy low then sell high so always keep yourself informed. Never sell on an upswing, or even, a downswing. If you don’t ride out a trend fully, you need to be really clear on your goals.

The majority of new products include a 90-day, or even 1-year, warranty, as it is; if the item is apt to malfunction, it will likely do so during that same time frame. An extended warranty is just a way to make more money.

If you’re one half of a married couple, the partner who has the strongest credit should be the one to apply for a loan. If you’re suffering from bad credit, building it can be done by getting a card that you can pay on time. You can share debt more equally with your spouse once you’ve improved your credit score.

Try to negotiate with any collections agents when they ask for money. These agencies usually buy your debt at a steep discount. As a result, they can also offer some savings to you. Use this to your advantage when paying off old debts.

Eating out less frequently is a great way to trim your budget. Making one’s own meals at home is thrifty and adds to appreciation of making the meal.

For high-ticket items, be sure to shop around to get the best price. To get a great deal, you need to shop around. If you aren’t finding a good deal, then there is always the Internet.

One easy way to earn a little extra money is to make use of an old, unused computer or laptop. If it’s working or it can be fixed then it can go for a little more money than broken ones do. Selling old things, such as a broken computer or old video games is a good way for some extra cash.

Over time, things sometimes happen outside of your control and you may find yourself in financial trouble even if you have always been careful. It is valuable to be aware of the amount of late fees, as well as the grace period, if any, you may have available to you. Know all of the options available to you before signing a lease for the next year.

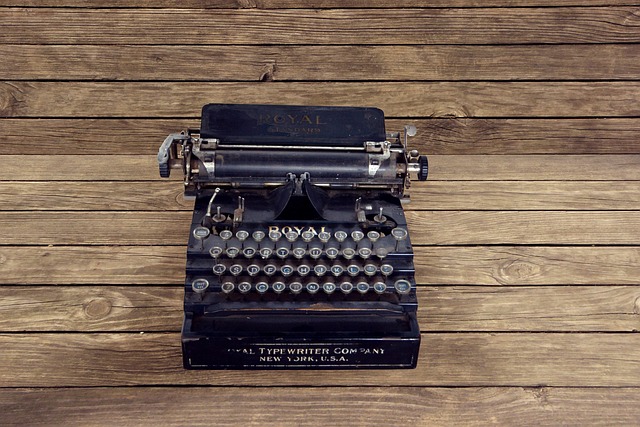

Balance your checkbook online if you don’t want to do it the old-fashioned way. Technology makes it easy to create a monthly budget and a savings plan.

The most important part of accumulating wealth is to always spend less than you make. People who spend 100% of their income each pay period, or worse, 110% of their income, never increase their net worth since they are spending everything that comes in. Figure out your total income, and never spend more than that.

Each day, save some money. Instead of taking a trip to the same place to purchase the same stuff, you should take advantage of ads from other places so that you can save a few dollars. Comparing prices will save you a lot of money because there are sales all the time you may not be aware of. Be willing to substitute food that’s on sale.

To save money, something you might want to consider is working from home. Commuting to a job can end up costing you a lot of money. Fueling up your car, parking it, buying pricey meals and arranging for daycare can all take healthy bites out of your paycheck.

Your IRA can be a very beneficial contribution for you to make during the course of your life. You’ll improve your future financial situation when you do! You can start an IRA account through your bank, a credit union, your brokerage firm or mutual fund companies. When contributed to regularly, IRAs can greatly impact your retirement funds.

No person desires eviction or foreclosure. However, if it improves your financial situation to have a smaller rent payment, then you may have to try to sell. You don’t want to be kicked out of your own home once your efforts to repay fail. There are those who try to act ahead of time.

Be sure that you set a day aside each month to pay the bills. This will allow you to reduce the stress as you will feel that you will not have to procrastinate. Make it visible on your calender and make sure that you stick to it. If you forget, this can cause a lot of future problems.

Once you know how to manage your money, it is important to put these concepts into action to avoid frittering away what you have earned. Invest your savings wisely to maximize your return on investment.