Patience, thorough knowledge of each company you invest in and keeping abreast of current trends are all helpful tools to help your investments succeed. This article can help you to successfully invest into the stock market. You will be able to start earning money right away.

Take advantage of free resources to investigate investment brokers before contracting with them. A thorough background investigation will lessen the chances of you falling prey to someone who will defraud you.

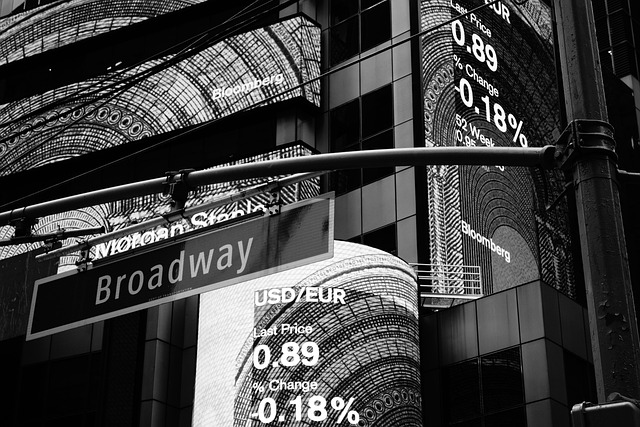

Stock Market

Spend time observing the market before you decide which stock to buy. You should have a good amount of knowledge before you get into the stock market. The best advise is to watch the upswings and downswings for a period of three years before investing. By doing this, you will possess more knowledge of how the stock market works. Therefore, you’ll have a greater possibility of making some money in the future.

Be sure you invest over an array of different stocks. It’s better to spread things out than it is to put all of your hopes into one stock. If you decided to put all of your money into one specific investment and the company fails, then you have just lost your entire investment and your loss is total.

If you’re targeting a portfolio based on maximum and long range yields, it is necessary that you purchase the strongest stocks coming from different industries. Even while the whole market grows on average, not all sectors are going to grow every year. With a portfolio that represents many different industries, you are in an excellent position to shift your resources towards the business sectors that are growing most quickly. Re-balancing regularly can help you lessen your losses in those shrinking sectors, but also allowing you a better position for when they grow again.

Instead of an index fund, consider investing in stocks that beat the 10 percent annual historical market return. The possible return of a stock can be calculated by adding its growth rate and dividend yield. For example, if a stock yields 4% and the projected earnings growth is 15%, you should receive a 19% return.

It is important to constantly re-evaluate your portfolio and investment decisions every few months. This is because the economy is changing all the time. Certain sectors will begin to outperform others, and some companies may even become obsolete. The best financial instruments to invest in may vary from year to year. It’s crucial to track your portfolio and make adjustments accordingly.

There are many brokers who offer online services as well as full service options, giving you the best of both worlds. You can manage half your portfolio by yourself while the other half is professionally managed. You will have a balance of professional management and personal control over your investment decisions.

Understand what you are competent in, and remain with it. You should stick to investing in companies that you are familiar with, especially if you invest through an online or discount brokerage without much expert advice. You probably have good judgement about companies in an industry you’ve worked in, but maybe not for companies well outside your area of expertise. Work with a professional broker or advisor to make these kinds of investing decisions.

Think about purchasing stocks what yield high dividends. If your stock declines some, you can get dividends to offset some of your losses. Of course if that stock increases in value, your dividends will be an extra bonus added to your earnings. Also, they will give you a periodic income.

For United States citizens, opening and maintaining a fully-funded Roth IRA is a smart investment strategy. Most middle-class citizens qualify for this opportunity. This type of investment is definitely long term. It’s important that you realize that an IRA is an investment for the future and not a quick tool for profiting.

Trading Volume

Make sure you’re closely watching the trading volume of stocks. Trading volume allows you to see the amount of activity a stock has during a specified amount of time. Know a stock’s activity, so that you know whether or not you should invest into it.

Purchase stocks in industries that you are familiar with. If you are extremely knowledgeable about an industry, you are in a better position to view it. You will not be a success in the stock market if you don’t take the time to learn about it. If you don’t know what you’re looking for to earn profit, you will never make money.

A portfolio which brings in eight percent interest is good, but one which brings in as much as twenty percent is great. There are always a few stock picks that can bring in even more. Choosing investments is tough, but if you do the proper research, you will be able to construct a portfolio tailored to your goals and needs.

It is not smart to be overly greedy in the stock market, even though many strategize otherwise. Having this characteristic has seen many investors losing serious amounts of capital. Instead, after you have garnered a nice profit, consider selling the stock and keeping your earnings.

If a business outperforms your expectations, this can be a good sign for the future. Negative changes should also be considered. Because of this, don’t lose sight of your goals in the investment process. There is usually a chain reaction when one event takes place.

Note the value of a stock as well as price. Consider whether or not the stock will be a good long term investment. If the stock’s price seems to be abnormally low, research this before you decide whether or not to buy the stock. Never purchase a stock simply because it has a low price.

Although just about anybody can participate in the markets, very few have all the right moves to make it a financial success. Focus on learning how stocks work and place your money in the best companies. Memorize the tricks you’ve learned today in order to start investing immediately!